From Startup to UPI Giant

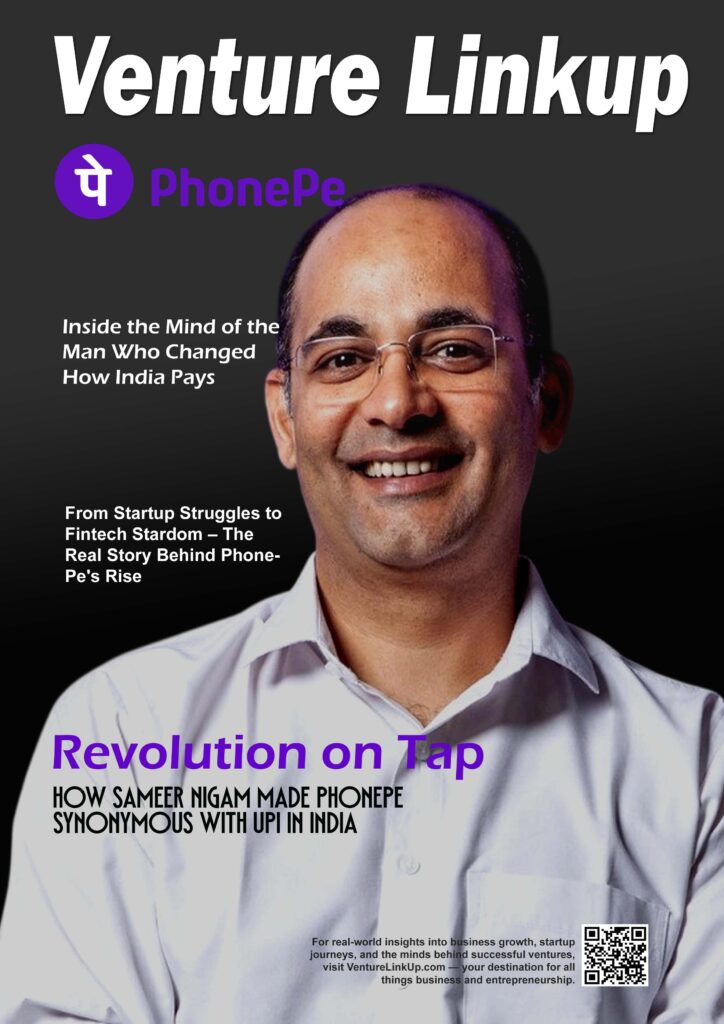

Digital payments in India changed forever with the rise of UPI. And behind that revolution stands Sameer Nigam, the mastermind who turned PhonePe from a bold idea into a household name.

In this blog post, we’ll explore Sameer’s journey—from his early days to building a platform used by over 500 million people. We’ll also look at how PhonePe made digital payments easy, secure, and lightning-fast for everyone.

The Man Behind the App: Who Is Sameer Nigam?

Sameer Nigam isn’t your typical startup founder. Before PhonePe, he worked as SVP of Engineering at Flipkart. But that wasn’t where his story began.

He graduated from the University of Mumbai, then moved to the U.S. for an MBA at Wharton. After gaining experience in Silicon Valley, he returned to India, driven by a simple mission: make money movement as easy as sending a text.

In 2015, that mission took shape. He quit Flipkart and, along with Rahul Chari, started PhonePe.

The Birth of PhonePe: A Game Changer in Indian Fintech

In 2016, just after the Indian government launched UPI (Unified Payments Interface), PhonePe was born. Timing couldn’t have been better.

Sameer saw UPI’s potential early. While other apps focused on wallets, PhonePe went all in on UPI. That decision changed everything.

Example:

Imagine you’re at a grocery store. No wallet. No cash. Just your phone. With PhonePe, you can scan a QR code and pay in seconds. That convenience, repeated millions of times daily, made PhonePe a favorite.

Why PhonePe Stands Out

Sameer knew that building trust was key. So, PhonePe focused on:

- User-first design: Simple, clean, and quick.

- Lightning-fast transactions: Often done in under 5 seconds.

- Security: Every transaction is encrypted and verified.

PhonePe didn’t stop at payments. It expanded into:

- Mobile recharges

- Utility bill payments

- Mutual funds

- Gold purchases

- Insurance

That’s how Sameer turned an app into a financial ecosystem.

Challenges Along the Way

Of course, it wasn’t all smooth sailing.

PhonePe had to compete with giants like Paytm, Google Pay, and later, WhatsApp Pay. But what made the difference was relentless focus.

Sameer once said in an interview, “You don’t build for today—you build for what India will be in five years.”

That mindset helped PhonePe stay ahead.

The Results Speak for Themselves

Here’s what PhonePe looks like today:

- Over 500 million registered users

- Leading UPI market share for months in a row

- Over 4 crore merchants across India using its platform

In fact, PhonePe processes over 4 billion transactions every month. That’s the scale Sameer envisioned—and achieved.

What Entrepreneurs Can Learn from Sameer Nigam

Sameer’s story is packed with lessons:

- Timing matters. Launching right after UPI gave PhonePe a head start.

- Focus wins. Going all-in on UPI while others hedged bets paid off.

- Solve real problems. People needed simple, secure payments. PhonePe delivered.

If you’re starting a fintech venture, studying Sameer’s journey is like reading a playbook on how to win in India.

Final Words

Sameer Nigam didn’t just build an app. He changed how India pays.

Through smart timing, sharp execution, and deep customer understanding, PhonePe became more than just a brand—it became a verb.

Next time you pay with UPI, there’s a good chance you’ll say, “PhonePe karo.”