The startup ecosystem in 2025 is more dynamic and competitive than ever before. With thousands of new ventures launching every month, investors have become sharper, more data-driven, and cautious about where they put their money. If you’re a founder looking to raise capital, understanding what investors really look for in 2025 can mean the difference between a quick YES and a long trail of rejections.

Here’s a detailed breakdown of what’s capturing investor attention in 2025:

1. Validated Problem and Demand

Investors no longer invest in ideas alone. They want to see proof that a real problem exists and that your product or service solves it effectively. This could be:

- Traction (early users or customers)

- Survey results and market research

- Testimonials or case studies

Pro Tip: Use tools like Typeform, Google Forms, or Hotjar to gather real user feedback and showcase insights in your pitch deck.

2. Scalable Business Model

In 2025, scalability is the magic word. Investors want to know: If this works, can it grow fast?

- Is your market size large enough? (TAM/SAM/SOM)

- Can operations and customer acquisition be automated or streamlined?

- Is the business model replicable in other geographies or verticals?

3. Strong, Complementary Founding Team

People bet on people. Investors in 2025 are putting their money on founding teams who:

- Bring diverse skills to the table (tech, marketing, ops)

- Have previous startup or industry experience

- Show adaptability and grit

Bonus Tip: Highlight team wins in previous ventures or jobs. Include team profiles in your pitch deck.

4. Unit Economics and Early Financials

Gone are the days when burning cash without a plan was acceptable. Even at an early stage, investors want a grip on your numbers:

- Customer Acquisition Cost (CAC)

- Lifetime Value (LTV)

- Gross margins

- Burn rate and runway

A solid understanding of these numbers builds trust and shows maturity.

5. Traction Over Hype

Buzzwords don’t raise funds; traction does. Show them:

- Revenue (even small)

- User growth trends

- Partnerships or pilots

- Waitlist signups or conversion rates

Even a small graph that shows momentum can do more than 10 slides of theory.

6. Clarity in Vision & Exit Strategy

Investors aren’t just investing in your startup; they’re investing in an exit. Be clear:

- What’s your 3–5 year vision?

- Do you plan to go IPO, get acquired, or stay private?

- Who are the potential acquirers in your space?

Even if it’s not guaranteed, having a clear direction adds credibility.

How to Align Your Startup With These Expectations?

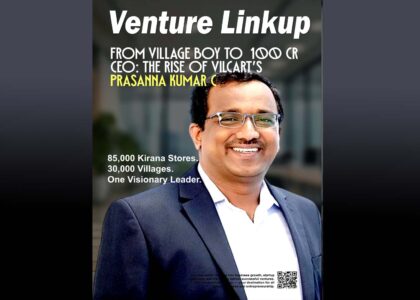

At VentureLinkUp.com, we help founders build fundable startups with clear positioning, pitch-ready decks, and investor matchmaking. Explore our resources, including:

- Pitch deck templates

- Investor readiness checklists

- Real case studies of funded startups

Learn more here: 100Cr Club

Final Thoughts

Startup funding in 2025 is all about clarity, proof, and potential. The earlier you align with what investors are looking for, the faster your journey to a successful funding round.

Prepare well. Think long-term. And remember — traction speaks louder than theory.

Want to increase your chances of getting funded? Subscribe to our newsletter on VentureLinkUp.com for weekly startup funding tips.